What is Liquid Capital: Exploring the Key Concepts and Benefits.

Introduction

In the world of finance, it’s essential to understand various terms and concepts that play a crucial role in the success of businesses and individuals alike. One such concept is liquid capital. In this comprehensive article, we will delve deep into the topic of liquid capital, exploring its definition, significance, and benefits. By the end, you will have a clear understanding of what liquid capital is and how it can impact your financial endeavors.

What is Liquid Capital?

Liquid capital refers to the available funds or assets that a business or individual possesses, which can be readily converted into cash without causing significant financial loss or disruption. It represents the financial resources that can be quickly accessed and used to meet short-term financial obligations or take advantage of investment opportunities.

The Significance of Liquid Capital

Having a healthy amount of liquid capital is essential for both businesses and individuals. It provides financial flexibility and ensures the ability to cover unexpected expenses, seize favorable business prospects, and weather economic downturns. Liquid capital acts as a safety net, allowing for immediate access to funds in times of need.

Key Characteristics of Liquid Capital

To better understand liquid capital, let’s explore its key characteristics:

- Cash and Cash Equivalents: Liquid capital primarily comprises cash or assets that can be easily converted into cash. Examples include money in bank accounts, short-term investments, marketable securities, and Treasury bills.

- High Liquidity: Liquid capital assets can be swiftly converted into cash without significant loss of value or lengthy processing times. They are highly liquid and readily available when needed.

- Minimal Risk: Liquid capital is associated with minimal risk since it is not tied up in illiquid assets or long-term investments. It provides a cushion against unforeseen financial challenges and ensures financial stability.

- Short-Term Focus: Liquid capital is predominantly focused on short-term financial needs and opportunities. It enables businesses and individuals to cover immediate expenses, pay bills, fulfill obligations, and capitalize on time-sensitive prospects.

Exploring the Benefits of Liquid Capital

Now that we have a solid understanding of what liquid capital entails, let’s examine the key benefits it offers:

1. Emergency Preparedness

Maintaining an adequate amount of liquid capital allows businesses and individuals to be prepared for unexpected emergencies. Whether it’s a sudden equipment breakdown, an unforeseen medical expense, or a natural disaster, having liquid capital readily available ensures that financial challenges can be addressed promptly without derailing daily operations or personal finances.

2. Business Expansion and Investment Opportunities

Liquid capital provides the means to pursue business expansion initiatives and capitalize on investment opportunities. It enables companies to invest in research and development, upgrade infrastructure, expand product lines, acquire competitors, or enter new markets. Similarly, individuals can take advantage of favorable investment prospects, such as real estate, stocks, or other ventures.

3. Cash Flow Management

For businesses, maintaining a healthy cash flow is vital for sustained operations. Liquid capital plays a critical role in managing cash flow effectively, ensuring that there is enough liquidity to cover operational expenses, payroll, inventory purchases, and other financial obligations. It provides stability and allows businesses to navigate through lean periods or unexpected disruptions.

4. Flexibility and Negotiation Power

Having a significant amount of liquid capital grants businesses and individuals greater flexibility and negotiation power. It allows them to negotiate better terms with suppliers, secure bulk discounts, negotiate lower interest rates on loans, and take advantage of early payment incentives. This flexibility can result in cost savings and increased profitability.

5. Peace of Mind

Maintaining a healthy level of liquid capital provides peace of mind. It eliminates the stress and anxiety associated with financial uncertainty. Knowing that there are sufficient funds readily available to handle emergencies or unexpected opportunities brings a sense of security and confidence.

FAQs about Liquid Capital

Q1: Why is liquid capital important for businesses?

Liquid capital is vital for businesses as it provides the financial flexibility to cover unexpected expenses, pursue growth opportunities, manage cash flow effectively, and negotiate better terms with suppliers. It acts as a buffer against financial uncertainties and ensures the overall stability of the business.

Q2: Can individuals benefit from having liquid capital?

Absolutely! Individuals can benefit from having liquid capital in various ways. It allows them to handle unexpected expenses, seize investment opportunities, manage personal cash flow, negotiate better terms for loans, and achieve financial security.

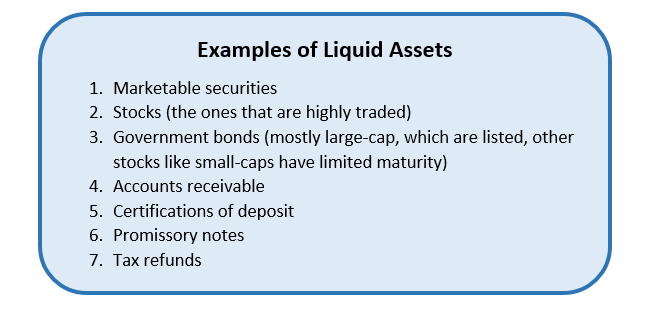

Q3: What are some examples of liquid capital?

Examples of liquid capital include cash in bank accounts, short-term investments like certificates of deposit, money market accounts, marketable securities, and easily tradable stocks and bonds.

Q4: How much liquid capital should a business or individual have?

The ideal amount of liquid capital varies depending on the specific circumstances, industry, and financial goals. As a general guideline, businesses should aim to have enough liquid capital to cover at least three to six months of operating expenses. Individuals should maintain an emergency fund equivalent to three to six months of living expenses.

Q5: Can liquid capital be invested for higher returns?

While liquid capital is primarily focused on short-term needs, it can still be invested in low-risk, highly liquid instruments that offer some return on investment. Examples include short-term Treasury bills, money market funds, or high-yield savings accounts.

Q6: What is the difference between liquid capital and working capital?

Liquid capital and working capital are related but distinct concepts. Liquid capital refers to the readily available funds or assets that can be quickly converted into cash. Working capital, on the other hand, represents the difference between current assets and current liabilities and is a measure of a company’s operational liquidity.

Conclusion

In conclusion, liquid capital plays a vital role in the financial well-being of both businesses and individuals. It provides the necessary flexibility, stability, and peace of mind to navigate through uncertain times and seize opportunities. By understanding the concept of liquid capital and its benefits, you can make informed financial decisions and ensure a stronger financial foundation.

:max_bytes(150000):strip_icc()/IFRS_Final_4194858-00f3f3a4c8334cc1aa13b29e692935db.jpg)